NO-ARBITRAGE IN HEATH-JARROW-MORTON

MODEL AND THE BOND PRICING EQUATION

MODEL AND THE BOND PRICING EQUATION

Abstract

In the present paper we discuss the relationship of no-arbitrage in Heath-Jarrow-Morton (H-J-M) model and no-arbitrage in the bond pricing partial differential equation approach. We show that the no-arbitrage condition of H-J-M translates, in terms of zero-coupon bonds, into the bond pricing equation. Conversely, we show that affine-yield solutions of the bond pricing equation, for the very general four-parameter short rate model, satisfy the H-J-M no-arbitrage condition without actually obtaining the solutions.

Citation details of the article

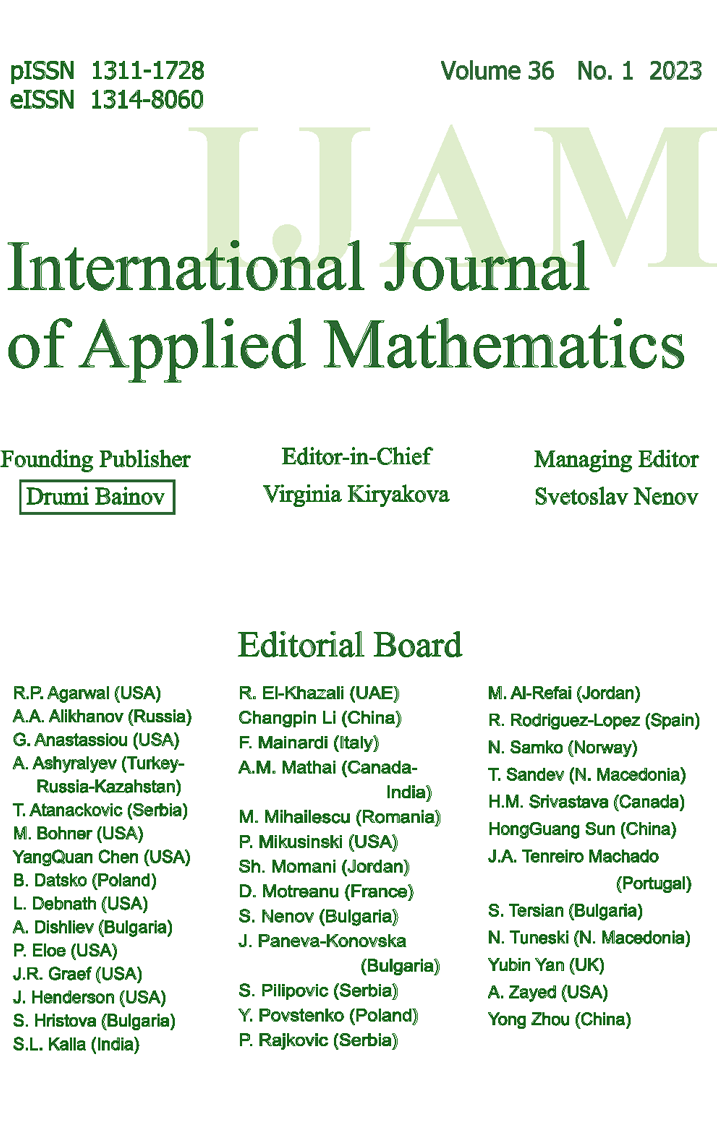

Journal: International Journal of Applied Mathematics Journal ISSN (Print): ISSN 1311-1728

Journal ISSN (Electronic): ISSN 1314-8060

Volume: 29 Issue: 5 Year: 2016 DOI: 10.12732/ijam.v29i5.6

Download Section

Download the full text of article from here.

You will need Adobe Acrobat reader. For more information and free download of the reader, please follow this link.

References

- [1] M.M. Chawla, On solutions of the bond pricing equation, Intern. J. Appl. Math., 23 (2010), 661-680.

- [2] J.C. Cox, J.E. Ingersoll and S.A. Ross, A theory of term structure of interest rates, Econometrica, 53 (1985), 385-408.

- [3] D. Filipov, Consistence Problems for Heath-Jarrow-Morton Interest Rate Models, Springer, Berlin, 2001.

- [4] I.V. Girsanov, On transforming a certain class of stochastic processes by absolutely continuous substitution of measures, Theory Prob. Appl., 5 (1960), 285-301.

- [5] D. Heath, R. Jarrow and A. Morton, Contingent claim valuation with a random evolution of interest rates, Rev. Futures Markets, 9 (1990), 54-76.

- [6] D. Heath, R. Jarrow and A. Morton, Bond pricing and the term structure of interest rates, A discrete time approximation, J. Fin. Quant. Anal., 25 (1990), 419-440.

- [7] D. Heath, R. Jarrow and A. Morton, Bond pricing and the term structure of interest rates: A new methodology, Econometrica, 60 (1992), 77-105.

- [8] D. Jara, An extension of Levy’s theorem and applications to financial models based on future prices, Ph.D Dissertation, Dept. of Math. Sciences, Carnegi Mellon Univ., 2000.

- [9] S.E. Shreve, Stochastic Calculus for Finance II: Continuous-Time Models, Springer International Edition, Third Indian Reprint, New Delhi, 2014.

- [10] O. Vasicek, An equilibrium characterization of the term structure, Journal of Financial Economics, 5 (1977), 177-188.

- [11] P. Wilmott, S. Howison and J. Dewynne, The Mathematics of Financial Derivatives: A Student Introduction, Cambridge University Press, Cambridge, 1995.