INVERSE PROBLEM STABILITY OF

A CONTINUOUS-IN-TIME FINANCIAL MODEL

A CONTINUOUS-IN-TIME FINANCIAL MODEL

Withdrawn (2017-01-19): This article has been retracted on author request.

Abstract

In this work, we study the inverse problem stability of the continuous-in-time model which is designed to be used for the finances of public institutions. We discuss this study with determining the Loan Measure from Algebraic Spending Measure in Radon measure space

Citation details of the article

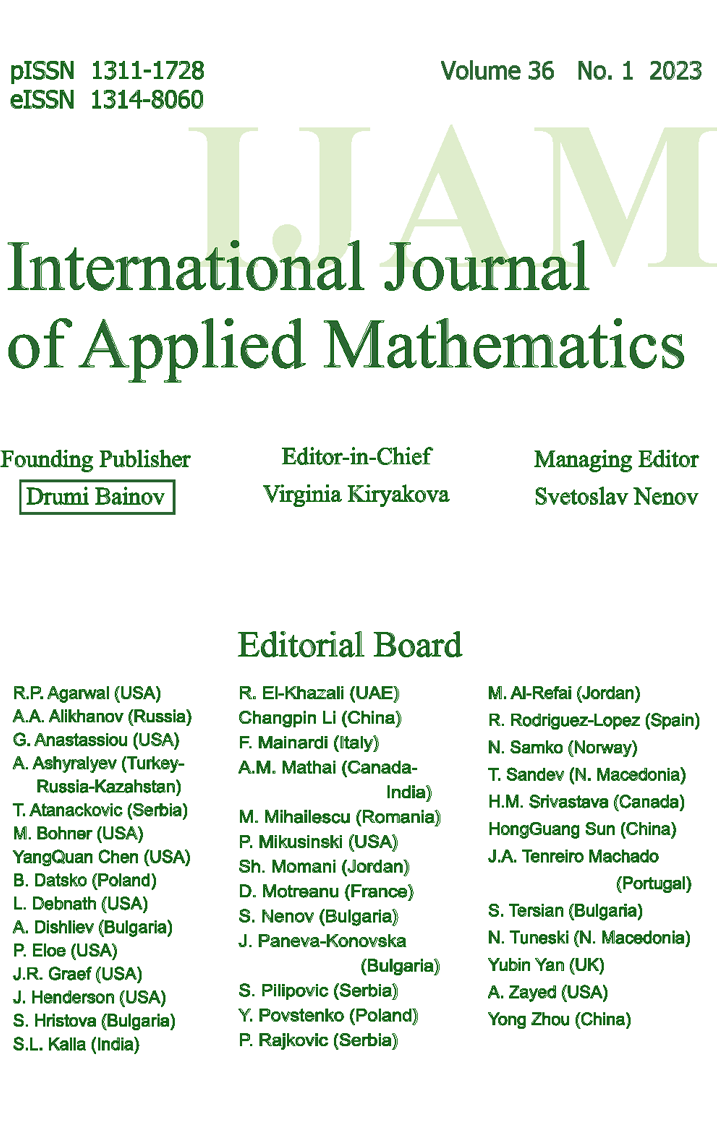

Journal: International Journal of Applied Mathematics Journal ISSN (Print): ISSN 1311-1728

Journal ISSN (Electronic): ISSN 1314-8060

Volume: 29 Issue: 5 Year: 2016 DOI: 10.12732/ijam.v29i5.9

Download Section

Download the full text of article from here.

You will need Adobe Acrobat reader. For more information and free download of the reader, please follow this link.

References

- [1] G. Freiling, V. Yurko, Inverse spectral problems for singular non-selfadjoint differential operators with discontinuities in an interior point, Inverse Problems, 18, No 3 (2002), 757.

- [2] J. Hadamard, Lectures on the Cauchy Problem in Linear Partial Differential Equations, New York (1923).

- [3] A.N. Tikhonov, V.Y. Arsenin, Solutions of Ill-posed Problems, VH Winston & Sons, Washington, DC (1977).

- [4] H.P. Baltes, Progress in Inverse Optical Problems, Springer (1980), 1-13.

- [5] G.W. Hanson, A.B. Yakovlev, Operator Theory for Electromagnetics, Springer Science & Business Media (2002).

- [6] Y.A. Abramovich, C.D. Aliprantis, An Invitation to Operator Theory, American Mathematical Society (2002).

- [7] K.E. Atkinson, The Numerical Solution of Integral Equations of the Second Kind, Cambridge University Press (1997).

- [8] E. Fr´enod, T. Chakkour, A continuous-in-time financial model, Mathematical Finance Letters, Article-ID2 (2016).

- [9] E. Fr´enod, M. Safa, Continuous-in-time financial model for public communities, In: ESAIM: Proceedings (2013), 1-10.

- [10] E. Fr´enod, P. Menard, M. Safa, Optimal control of a continuous-in-time financial model, Mathematical Modelling and Numerical Analysis (2013), Manuscript in revision.

- [11] E. Fr´enod, P. Menard, M. Safa, Two optimization problems using a continuous-in-time financial model, Journal of Industrial and Management Optimization (2014), Manuscript in revision.

- [12] R.C. Merton, Theory of finance from the perspective of continuous time, Journal of Financial and Quantitative Analysis, 10 (1975), 659-674.

- [13] R.C. Merton, Continuous-Time Finance, Blackwell (1992).

- [14] Sundaresan, M.Suresh, Continuous-time methods in finance: A review and an assessment, The Journal of Finance, 55, No 4 (2000), 1569-1622.

- [15] C. Chiarella, M. Craddock, N. El-Hassan, The calibration of stock option pricing models using inverse problem methodology, QFRQ Research Papers, UTS Sydney (2000).

- [16] H.Egger, H.W. Engl, Tikhonov regularization applied to the inverse problem of option pricing: Convergence analysis and rates, Inverse Problems, 21, No 3 (2005), 1027.

- [17] J. Masoliver, M. Montero, J. Perell´o, G.H. Weiss, Direct and inverse problems with some generalizations and extensions, Arxiv preprint (2007).

- [18] T. Chakkour, E. Fr´enod, Inverse problem and concentration method of a continuous-in-time financial model, International Journal of Financial Engineering, 3, No 2 (2016), 1650016.

- [19] K.E. Atkinson, The Numerical Solution of Integral Equations of the Second Kind, Cambridge University Press (1997).