AN ANALYSIS OF THE DAILY VARIATION OF THE VALUE

OF AN OPTION OF A SHARE THROUGH

THE BLACK-SCHOLES EQUATION

OF AN OPTION OF A SHARE THROUGH

THE BLACK-SCHOLES EQUATION

Abstract

In this work we study the daily variation of an option through a mathematical model known as Black-Scholes equation. This model expresses the variation rate on the derivative price, regarding time, as a linear combination of three terms: the own derivative's price, the speed with which it varies regarding the share price, and how this variation is accelerated. The main goal is to analyze the theoretical model's approximation when applied to practice, for this is presented the Black-Scholes model's solution and posteriorly applied on a European call option. This allows us to come to the conclusion that the theoretical model presented itself is a fine approach with the market.Citation details of the article

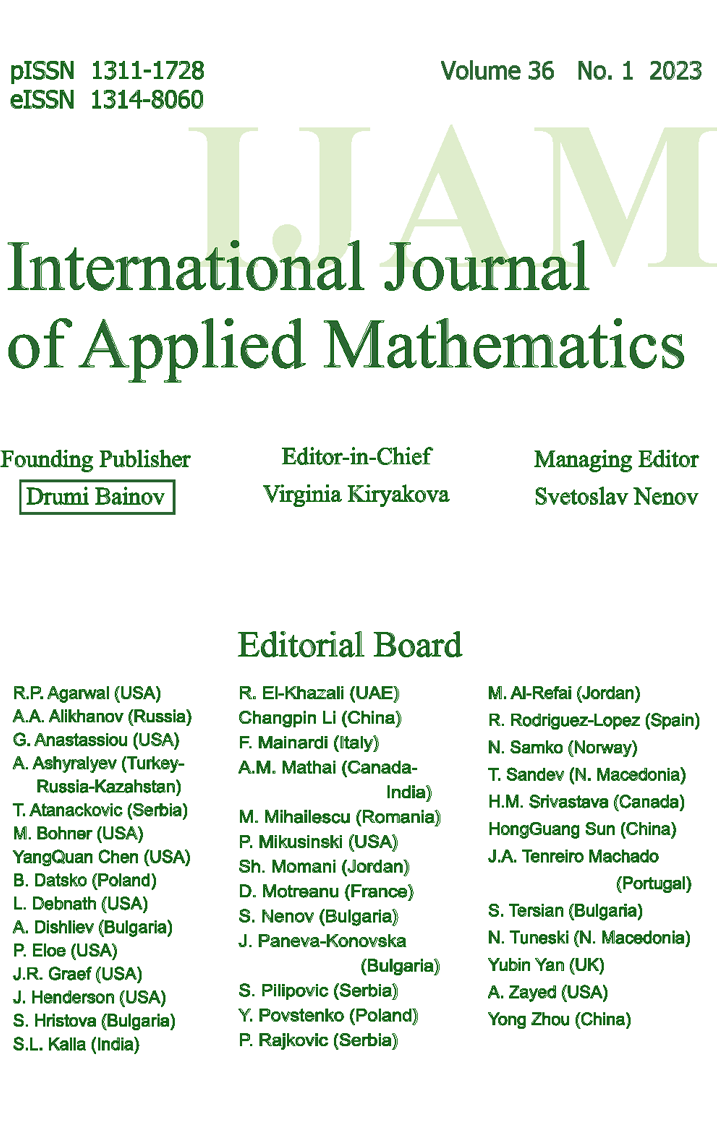

Journal: International Journal of Applied Mathematics Journal ISSN (Print): ISSN 1311-1728

Journal ISSN (Electronic): ISSN 1314-8060

Volume: 30 Issue: 3 Year: 2017 DOI: 10.12732/ijam.v30i3.3

Download Section

Download the full text of article from here.

You will need Adobe Acrobat reader. For more information and free download of the reader, please follow this link.

References

- [1] S. Benninga, B. Czaczes, Financial Modeling, MIT Press (2000).

- [2] F. Black, M. Scholes, The princing of options and corporate liabilities, The Journal of Political Economy, 73 (1973), 637-654.

- [3] M.R. Grossinho, Metodos numericos em financas. ISEG (2009).

- [4] M. Horn, Explain the concept of implicit volatility and how it measured, in the context of options prices, outline, and critically assess, the uses that can be made of implicity volatility, EC 372 Term Paper, Department of Economics, University of Essex (2009).

- [5] J.C. Hull, Options, Futures, and Other Derivative. Pearson Education India (2006).

- [6] V.M. Iório, EDP: Um curso de graduação. Instituto de Matemática Pura e Aplicada (1989).

- [7] I. Stewart, Dezessete equacoes que mudaram o mundo, Zahar (2013).

- [8] P. Wilmott, S. Howison, J. Dewynne, The Mathematics of Financial Derivatives: A Student Introduction. Cambridge University Press (1995).